16 expense management options for small and large businesses

16 Expense Management Options for Small and Large Businesses Spending management software brings management, clarity, compliance, and documentation to help businesses lower prices, move away from useless spending, and pay distributors or workers on time.

Companies define a price range for many actions such as insurance coverage, capital equipment, and inventory resupply. However, price range leaks hurt your organization's revenue margins when spending remains uncontrolled.

Moreover, as an organization expands, these points may develop in challenging quantities for the profitability of your organization. Due to this fact, companies of all sizes use spending management software to monitor and maintain outgoing cash throughout the company's price range.

What is Spending Management?

Spending management is the way of managing all the organization's purchases and provider's funds. The first goal is to account for every dollar that comes out of the company's account and get the perfect value.

Spend management insurance policies should automate and combine all spending-related actions from supply to vendor settlement. This rigorous application should ensure that procurement processes are deliberately proceeding by the organization's stakeholders.

Moreover, it charges distributors, contractors, and various third party events through the contract compliance cycle.

The importance of spending management

Typical spending management procedures provide the following benefits:

- Enterprise effectiveness by automating spending and expense control processes that can be error-prone and tedious if delegated to workers.

- Reduce risk and pricing because the software tells you regarding the product being purchased, the identity of the seller, and the price associated with the purchases.

- Higher collaboration between enterprise sources and third events can be achieved when you notice a normal spend management cycle with a digital application.

- Sustainable productivity improvements by releasing workers from normal work and allowing them full income-generating duties for your company.

Here are the perfect spend management tools that allow you to afford all the spending under your management and get the perfect value for the cash you spend:

Bayhook

Payhawk is a spending management platform for businesses across Europe and the United States that automates global spending management, reduces routing processes by 87%, and allows on-time billing funds and custom spending limits.

The platform leverages approval workflows, accounting integration, and real-time reporting to handle and control spending.

The software helps track and monitor every organization's expenses and transactions in real-time using expense management software. Provides insights for planning and forecasting while sharing experiences with stakeholders and senior management.

You can hint at all boxes by tying the playing cards of the employee's corporate visas and setting spending limits for people and groups.

The platform provides homeowners in the price range with extensive updates on their pledge billing, enabling them to judge accurate and expected spending and monitor the price range that is reachable.

The Payhawk platform allows the creation of insurance policies for spending using optimized workflows and simplifying card controls, along with recurring transaction limits, ATM withdrawals, and hierarchical approval sequences.

By automating processes and having a unique IBAN for billing funds available through SEPA Instantaneous and Sooner Funds, Payhawk has successfully reduced month-to-month closures by up to 5 days.

Air Base

Airbase is a complete spending management software for different types of companies, such as early-stage companies, small businesses, mid-market companies, pre-IPO companies, and corporations. It offers a range of superior spending, auditing, and control management options.

For example, the receipt management module allows enforcing compliance, attaching easy receipt, custom emails, sharing receipts from another tool, etc.

In addition, there are security and fraud detection modules to allow card management, card limits, card blocking, fraud detection, fraud notification, encrypted sharing of digital card data, etc.

Zoho Fees

If you're a rising up business, Zoho Expense is the perfect solution for managing your trip and expenses. It helps companies automate expense reports, streamline the company journey, manage spending, and achieve critical cash insights.

Moreover, the answer leverages AI-powered expertise to detect fraud with the goal of conducting higher audits and preparing for tax season.

With Zoho Expense, managing your online and offline booking turns into a seamless end-to-end tour desk management process. In addition, it automates expense generation from receipts and eliminates directory errors across the web payment cycle.

This tool additionally allows you to examine your price range with your exact expense. Automated purchase orders, exercise monitoring for audit trail, contextual and real-time collaboration between departments are various key options for answering.

Walster Foundation

Wallester Enterprise is an all-in-one enterprise expense management software. Businesses can handle all company spending from a single platform where you will be able to monitor all invoices in real-time. With this platform, you will be able to subject your workers' digital playing cards in minutes to company bills.

You can even provide shared access to digital playing cards for a number of individuals involved in a similar task. Enterprise gaming cards are highly secure with the 3D Safe 2.0 system. Moreover, they share notifications instantly to reduce the likelihood of fraud cases.

Companies may even monitor their progress towards the limits of the price range and receive alerts once they exceed their limits. Creating daily and monthly limits for people, various fee and money withdrawal strategies, categorizing transactions, and attaching receipts to these various premium options promises this program.

Amperes

Emburse provides complete spending management tools for mega multinational startups. His options include expense management, accounts payable, purchase automation, simplified fee system, auditing, trip management, and dashboards.

Emburse provides digital playing cards that may be properly issued across its platform, using software known as Emburse Spend. Emburse's digital playing cards combine seamlessly with the software used by accounting and AP groups, along with Emburse Chrome River, Emburse Certify, or one of the different goods available. Items like Emburse Go help tour managers maintain an in-depth look at those who spend their holidays and their bills.

One of the best factors is Emburse's modular method of managing institutional spending, relying on company measurement. Emburse Tallie works effectively for small and medium-sized businesses. Emburse Certify works effectively for US-based organizations.

Emburse Chrome River works effectively for large organizations with processes, no matter where the workplace depends. Major companies such as Microsoft, Nike and Estee Lauder use Emburse."

Spendesk

Spendesk has many useful and intuitive options, along with integrations and optical character recognition (OCR). With this software, your organization can automate all recurring invoices. Moreover, they are highly efficient and sufficient to match expense claims to the invoice in question and save time.

Spendesk can be a versatile program so that businesses can customize it through their spending management methods. For example, you assign opponent playing cards to a certain spend for certain employees. Plus you can also assign digital bank cards for single-use jobs.

Moreover, it offers push notifications for fee verification, accounting software integration, an overview of invoices, and a comprehensive spending dashboard.

severs

Coupa is another widespread enterprise spending management (BSM) software with cloud entry. It can handle spending in all diverse enterprise sectors such as funds, chain provisioning, procurement, treasury, etc. There are three sets of tools for managing spending.

The basic stack of tools are the purposes. This group covers all important modules such as procurement, invoicing, expenses, payment, contract management, strategic supply, expenditure valuation, etc.

The second group is the BSM platform which focuses on consumer privacy, profile, information integrity and integration. It features a related core, cloud input, integration, graphical user interface (GUI), etc.

And finally, the third group is the group of Coupa institutions. It offers options such as an open enterprise community, Coupa benefits, and AI suite.

Mesh Boxes

Mesh Payments is more software than the ones you should take advantage of and stop spending leakage. First, the performance of Spend Insights provides you with valuable information insights whenever you want. Every time you see an item you spend, the cellular app routinely offers alternatives to financial savings sooner or later, spent in forecasting for current fees, etc.

Secondly, its spending console will get real-time fee request alerts, allowing you to restrict spending, cancel subscriptions from a single centralized interface, and block sellers' funds with a single click. Various notable options include spend optimization, real-time reporting, and automated fee workflows.

slope

The ramp divided its enterprise spending management system into 4 megabytes: Begin, Scale, Streamline, and Save. The Begin module provides you with access to tools to handle multiple playing cards, billing money (ACH/checks/playing cards), real-time expense monitoring, and correct spending calculation.

The unit of scale allows you to implement the insurance policies of the organization in relation to spending and billing. For example, you should use expense insurance policies to establish guidelines and spending controls to implement these spending indicators.

The Streamline module provides you with several workflows (Onboarding, Collaboration, Accounting) to automate spending management and combine (1000+ integrations) with different enterprise tools. Finally, the Save module exists to cater to your wishes for receipt matching, expense classification, value intelligence, financial savings insights, etc.

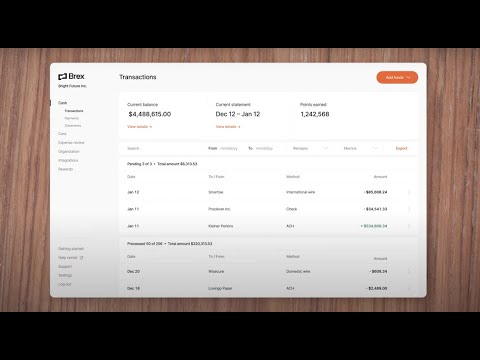

Brix

Brex is all about accelerating the funds of an organization's operations while complying with corporate insurance policies for spending and billing. By enabling the worker to submit the right invoices and the accounting workforce to audit invoices effortlessly, Brex develops a tradition of monetary self-discipline among many companies and their beneficial human resources.

Brex affords varied firm expense administration options like bank cards, enterprise accounts, expense monitoring, integrations, and so forth. It's additionally bringing the spend administration characteristic for the Brex Empower subscription.

Workday

Workday, the famous human capital administration software, additionally began providing easy and strategic methods to handle enterprise spending. It comes with an intuitive, easy, and lightweight graphical consumer interface for spending administration from one centralized platform.

Its UI has 3 primary tabs: Supply to Pay, Stock, and KPIs. The Supply to Pay module offers precious information insights on Provider Spends, Managed vs. Unmanaged Spend, Provider efficiency, Bill Processing, and so forth.

Furthermore, it’s a cloud-based app so that you simply and your enterprise stakeholders can keep watch over firm spending from any gadget and any place with a web connection.

Paytm

Paytm is all about superior automation within the spend administration vertical of your enterprise. It brings vendor subscriptions and SaaS subscriptions for workers in a single place. Thus, you don’t want to purchase separate software programs for various spend heads.

On PayEm, you'll be able to create and subject digital bank cards for various third-party distributors and assign some extent of contact particular person for spending administration. You too can apply the identical technique to software program subscriptions.

Moreover, you get the final word of PayEm's spending management authority. Thus, you will be able to stop overspending on software subscriptions by getting rid of useless apps or previous worker accounts from existing applications.

Multiplayer

The cloud-based Teampay app puts financial groups in the driver's seat so they can visualize all the spending from completely different sectors of your organization. Stakeholders also get real-time view based on regular spending and may impose restrictions on quick spending if necessary.

It also provides a conversation user interface so workers can get real-time assistance from the financial workforce to learn to shop for the course or get approvals for transactions. Moreover, you don't want to attend to the next month's bill to see how your workers are spending. You'll get real-time information on current spending.

Jagger One

JAGGAER ONE can be a very popular identity for supply-to-payment procedures that combine all expenses from completely different sectors in one place for simple supervision of company expenses. The carefully designed app allows you to handle diagonal and direct bills from one easy program.

It provides ultra-superior information analytics and statistics by combining AI with the robotic path to automation (RPA). Thus, you may get actionable information to restructure the spending management cycle, such as creating a procurement catalog for your entire organization.

RealPage

RealPage helps you grow until you become cost-effective and productive when you deal with distributors, invoices, and purchases on this software. It's not just spending monitoring software.

It collects spending and income information for all of your organization's portfolios and provides you with informative insights into good purchases. Furthermore, it helps you automate all purchase orders (POs) and their approval processes while feeding real-time information into a centralized dashboard to monitor and evaluate spending.

Concor Expenses

Concur Expense is a spending management provided by SAP, a renowned ERP software developer for enterprise operations. The product helps you combine and automate enterprise spending management by linking multiple supply transactions to payment.

The program is beneficial for every worker and employer. For example, workers in the discipline can provide their expense slips from a cell phone. Concur smart software will routinely confirm expenses and send you a notification to approve spending faster.

closing phrases

With spending management software, you'll be able to unknowingly fill in loopholes that drain money and help your organization generate revenue margin. You may also need expense tracking devices at the highest level if your organization has to pay back money made by workers or distributors.